pamspix/Getty Images: Illustration by Issiah Davis/Bankrate Reverse mortgages generally allow homeowners aged 62 or older to tap their home equity and receive tax-free cash payments while remaining in their homes. To help you compare reverse mortgage options, we’ve rounded up a list of the best reverse mortgage lenders to consider.…

Credit: RoschetzkyIstockPhoto/Getty Images; Illustration by Issiah Davis/Bankrate For Texans looking to buy a home, now might be a good time to start your search. According to Redfin, the median price of a single-family home in the Lone Star State is $340,500, down 2.6% from a year earlier. At the same…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

Credit: Marje/Getty Images; Illustration by Issiah Davis/Bankrate If your credit needs work, that doesn’t necessarily mean you won’t qualify for a mortgage. There are lenders and loan programs for borrowers with bad credit, including FHA loans. However, you’ll have your work cut out for you: During the third quarter of…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

A 16th birthday is a major milestone. There’s the driver’s license, the newfound freedom, the open road. Then, for most families, comes the insurance bill. “It was exhausting,” said S. Bowers, an Ilinois-based project manager mom who recently shopped for car insurance for her 17-year-old…

Dept Managmnt

2. Coaching and Tutoring Take stock of your areas of expertise – maybe you speak a second language or solving math equations comes…

Banking

OBSERVATIONS FROM THE FINTECH SNARK TANKBankers wants to discuss AI strategy. They’re excited about chatbots, machine learning models, generative AI tools, and AI…

Credit Cards

All News

Roth IRAs allow your savings to grow tax free and allow tax free withdrawals in retirement. Your income determines whether you can contribute and how much you can add. The IRS sets annual income limits based on your tax filing status. These limits decide whether you can make a full…

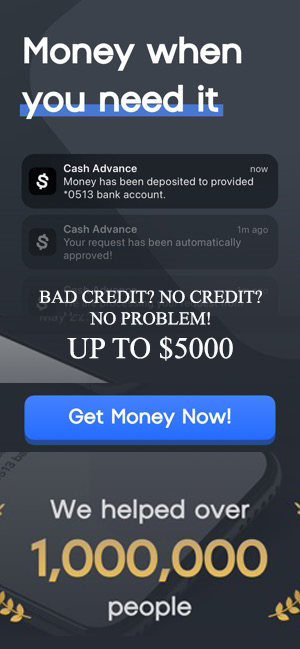

Key takeaways Technology is making it easier for scammers to defraud consumers out of billions of dollars with different schemes. Lenders that guarantee loan approvals for an upfront fee are likely personal loan scammers. Consumers with lower incomes and poor credit are more likely to be targeted by scammers. If…

Klaus Vedfelt/Getty Images Key takeaways You’re more likely to secure a personal loan despite a low income if you apply for a smaller loan amount, apply with a cosigner or work with an online lender. Be wary of credit card-like interest rates, even from reputable lenders, if you don’t have…

Photo courtesy of Karen Bennett; Illustration by Hunter Newton/Bankrate Currently, you can lock in annual percentage yields (APYs) on certificates of deposit (CDs) at and slightly above 4% with many nationally available CDs. Only a select few financial institutions offer promotional CDs that earn a 5% APY or greater, and…

Truist Bank, one of the top 10 commercial U.S. banks, offers deposit accounts, loans, mortgages, credit cards and more for both consumers and businesses. Its presence is marked by over 1,900 branch locations spread across 17 states and Washington, D.C. Truist near me If you’re on the lookout for a…

Key takeaways When selecting the best bank account for kids, prioritize accounts with no monthly maintenance fees or minimum balance requirements to maximize savings. Choose accounts that offer parental controls and educational tools so you can help guide your child’s financial education. Consider the age requirements and geographic and membership…

Willowpix/ Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways You can deposit money into someone else’s bank account via electronic transfer, wire transfer or by depositing cash in person at a branch. Some banks restrict cash deposits to accounts that are not in your name to prevent money laundering and…

Key takeaways Verify you’re on legitimate bank websites and apps before entering login information — hackers create convincing fake sites to steal credentials. Use strong, unique passwords for each financial account and enable two-factor authentication for an extra layer of security. Be skeptical of urgent messages asking for personal information…

Hiya Images/Corbis/Getty Images Key takeaways A checking account is for managing your day-to-day finances, such as paying bills, making debit card transactions and writing checks. A savings account is for storing funds for emergencies or short-term goals, and the money typically earns a modest amount of interest. An effective money…

With less than a week to go before the big day, you’ve got the big bushy Christmas tree, the perfectly wrapped presents, the festive turkey with all the fixings, and all of the other details that come with the holidays. From dinner parties to dressing up and decorating the home,…