Key takeaways There are several ways to finance home renovations, including renovation mortgages, home equity loans and personal loans. Borrowing makes the most sense when repairs are urgent or when improvements will increase your home’s value. Compare loan options carefully, considering interest rates, fees and the amount of home equity…

Image by GettyImages; Illustration by Bankrate Key takeaways Non-qualified mortgages, known as non-QM loans, are an option for those who might struggle to qualify for a standard mortgage, such as self-employed borrowers and gig workers. Non-QM loans have more flexible income and credit standards, but they require higher down payments…

DenisTangneyJr/Getty Images Key takeaways Bridge loans are short-term loans that help cover costs during transitional periods, most often if you must buy a new home before selling your old one. Like a mortgage, your home may serve as collateral for a bridge loan. Some bridge loans allow you to pledge…

pamspix/Getty Images: Illustration by Issiah Davis/Bankrate Reverse mortgages generally allow homeowners aged 62 or older to tap their home equity and receive tax-free cash payments while remaining in their homes. To help you compare reverse mortgage options, we’ve rounded up a list of the best reverse mortgage lenders to consider.…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Credit: ©️ Allard Schager/Getty Images; Illustration by Issiah Davis/Bankrate Shopping for a home in Florida often means navigating a market of extremes, from modest homes in rural areas to multimillion-dollar mansions and high-rises in Miami. Overall, it’s a mixed picture for the housing market in…

Dept Managmnt

2. Coaching and Tutoring Take stock of your areas of expertise – maybe you speak a second language or solving math equations comes…

Banking

OBSERVATIONS FROM THE FINTECH SNARK TANKBankers wants to discuss AI strategy. They’re excited about chatbots, machine learning models, generative AI tools, and AI…

Credit Cards

All News

Key takeaways There are two main types of student loans: federal and private. Federal student loans are easier to qualify for and have more flexible repayment options than private loans, including far more paths to loan forgiveness. Private student loans may offer lower interest rates with higher loan limits for…

The short answer, while credit cards technically cost more in interest (if balances are carried), Buy Now, Pay Later (BNPL) often costs you more in monthly cash flow and budget flexibility. In most cases, Buy Now, Pay Later (BNPL) plans cost your budget more in the new year than credit…

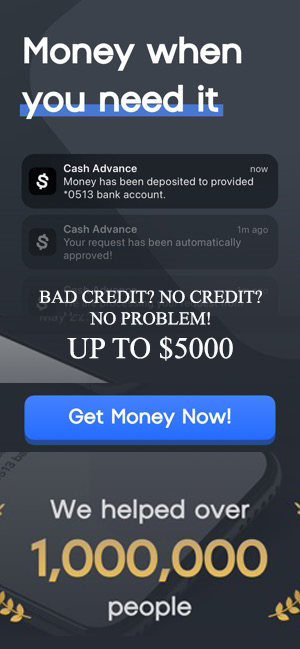

Key takeaways No-credit-check loans target borrowers with poor credit or limited credit history. These loans often carry sky-high interest rates, sometimes exceeding 100% APR. These loans should be approached with great caution and as a last-resort funding option. Obtaining a loan when you have bad credit can be challenging, as…

Key takeaways The amount you can afford for a car depends on whether you’re buying or leasing — the latter could be much cheaper and let you access more options. Your salary, debt-to-income ratio and credit profile could also affect how large of a car loan you’ll be offered. Be…

Key takeaways Your required minimum distribution (RMD) amount changes each year based on the IRS’s life expectancy calculation for your age. You calculate your RMD by dividing your year-end account value by the estimated remaining years in your lifetime, as per an IRS table. If you miss the RMD deadline,…

Yellow Dog Productions/ Getty Images; Illustration by Austin Courregé/Bankrate You’ve picked out your new car at the dealership and qualified for a car loan, but before you can sign on the dotted line and drive away, the dealer says you need full coverage car insurance. Full coverage car insurance typically…

Driving under the influence of alcohol or drugs is one of the single most expensive mistakes you can make on the road. If you’re charged with a DUI, tickets and fines are only the start of your financial challenges — but the total cost of a DUI can add up…

Rolf Bruderer/Getty Images Key takeaways Gap insurance covers the difference between your claim payout and your remaining loan or lease balance if your car is stolen or totaled in a covered claim. Gap insurance is typically less expensive when purchased as a policy endorsement through your insurance company rather than…

There’s Still A Nationwide Shortage Of Homes — So Why Are Sellers Getting Desperate In Some Places?

For years, Americans have heard this mantra: There isn’t enough housing in the United States. The ongoing shortage explains why affordability is such a challenge, and why so many Americans are spending their 30s as renters rather than homeowners. The reality has grown a bit more complicated. As the housing…

This past Thanksgiving weekend saw a record-breaking 203 million shoppers, surpassing the 197 million in 2024, according to the National Retail Federation’s Annual Consumer Survey. Americans are gearing up to do more holiday shopping ahead of the holidays. In a world where consumerism often overshadows sentiment, consumers are looking for…