Credit: Marje/Getty Images; Illustration by Issiah Davis/Bankrate If your credit needs work, that doesn’t necessarily mean you won’t qualify for a mortgage. There are lenders and loan programs for borrowers with bad credit, including FHA loans. However, you’ll have your work cut out for you: During the third quarter of…

A smart personal finance strategy often involves earning some interest on your money while not taking on too much risk. These days, high-yield savings accounts are one viable option, with top rates reaching over 4% APY — significantly outpacing the current inflation rate of 2.7%. In addition to savings accounts,…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

Credit: Images by Getty Images; Illustration by Issiah Davis/Bankrate When you work with an online mortgage lender, the entire application process often happens without any face-to-face interaction. Online mortgage companies don’t have branch locations; instead, they operate exclusively online. To assemble our list of the best online lenders, we’ve reviewed…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

A complicated U.S. economy. Stubborn inflation and a jobless boom. Unprecedented conflict with the president. Personnel changes, and a new Fed chair. Federal Reserve officials are no stranger to difficult economic moments, but the upcoming year could prove to be more dramatic than usual for…

Dept Managmnt

Delmaine Donson/Getty Images Debt relief companies work on your behalf to negotiate your debts, usually through a settlement for less than you owe.…

Banking

OBSERVATIONS FROM THE FINTECH SNARK TANKBankers wants to discuss AI strategy. They’re excited about chatbots, machine learning models, generative AI tools, and AI…

Credit Cards

All News

Credit counseling helps you start the year with a plan by transforming vague financial resolutions into a concrete, actionable roadmap. By partnering with a certified credit counselor, you gain a structured budget, a clear understanding of your debt-to-income ratio, and access to tools such as Debt Management Plans (DMPs) that…

If you’re looking for a credit card that can cover the majority of your needs, the Chase Freedom Unlimited® is a great option to consider. It consistently ranks among the best credit cards on the market, providing outstanding value for no annual fee. Making the card even more appealing, you…

Top yields for savings and money market accounts are expected to continue the downward slide in 2026. Still, top savings rates will likely outpace the rate of inflation according to the latest forecast from Bankrate senior industry analyst, Ted Rossman. The highest rate for nationally available savings and money market…

Key takeaways A high credit score and income are crucial to qualifying for the lowest rates on a personal loan. Improving your score before applying for a personal loan could help you secure a lower rate. Shopping for the best rates with at least three lenders or on a marketplace…

Selling real estate can result in a significant profit, but it may also trigger capital gains taxes depending on whether the property qualifies for IRS exclusions, how much was earned and how long you owned the property. In most cases, capital gains taxes are owed for the tax year in…

A Roth IRA offers tax-free growth and tax-free withdrawals in retirement, which can benefit young adults with long time horizons. You can help open a Roth IRA for an adult child if they have earned income and the account is in their name. Starting early allows more time for growth.…

To recover from holiday spending without stress, you must first assess the damage by tallying all holiday receipts and statements. Once you have the total, create a recovery budget that excludes discretionary spending and prioritizes debt repayment using strategies such as the debt snowball or avalanche. Accelerate this process by…

Justin Sullivan/GettyImages Brokerages are aggressively competing for your money. One way they do that is by offering competitive bonuses in the form of cash that you can add right to your brokerage account. Bankrate tracks the best brokerage account bonuses to help you compare active offers. Best brokerage account bonuses…

From macroeconomic factors like inflation and job-market uncertainty to sector-specific disruptions, investors face risks big and small. Building a portfolio that has at least some less risky assets in it can be useful to help you ride out market volatility. The trade-off, of course, is that in lowering risk exposure,…

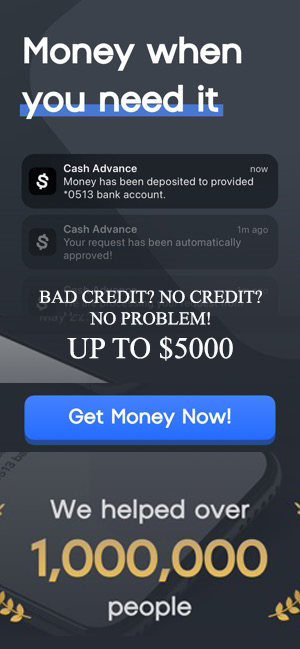

PBNJ Productions/ Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways Several emergency loan types, including personal loans and credit card advances, can fund urgent needs quickly — in some cases within one business day. Payday loans and title loans should be used as a last resort since they come with…