A smart personal finance strategy often involves earning some interest on your money while not taking on too much risk. These days, high-yield savings accounts are one viable option, with top rates reaching over 4% APY — significantly outpacing the current inflation rate of 2.7%. In addition to savings accounts,…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

Credit: Images by Getty Images; Illustration by Issiah Davis/Bankrate When you work with an online mortgage lender, the entire application process often happens without any face-to-face interaction. Online mortgage companies don’t have branch locations; instead, they operate exclusively online. To assemble our list of the best online lenders, we’ve reviewed…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Key takeaways An LLC has access to some small business loans that are designed specifically for funding a variety of business expenses. LLC loans can be used for many things, including working capital, covering start-up costs, equipment or inventory purchases, advertising and marketing and even…

Dept Managmnt

Delmaine Donson/Getty Images Debt relief companies work on your behalf to negotiate your debts, usually through a settlement for less than you owe.…

Banking

OBSERVATIONS FROM THE FINTECH SNARK TANKBankers wants to discuss AI strategy. They’re excited about chatbots, machine learning models, generative AI tools, and AI…

Credit Cards

All News

Whether you can claim an adult child as a dependent on your taxes depends on their age, income and living situation, as well as the level of financial support you provide to them. The IRS allows parents to claim certain adult children if they meet the criteria for either a…

With interest rates somewhat in flux, savers and investors might have to search a little bit harder to find the best returns from relatively safe investments such as money market funds. Money market funds invest in short-term securities issued by governments and corporations and are available from several different brokers…

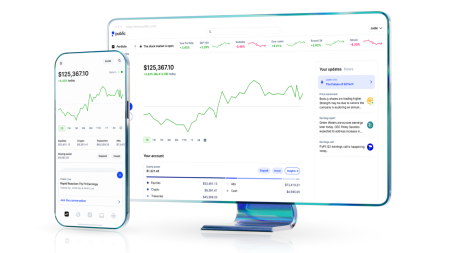

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you can trade with as little…

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a…

Capital gains are the profit you earn when you sell an asset like a home, business or stocks. Those gains are subject to capital-gains taxes, but capital gains are taxed differently depending on the type of asset — and how long you owned the asset. That’s because, while the federal…

Key takeaways The first step to saving is setting specific, achievable goals and tracking your progress using a digital budgeting tool, spreadsheet or pen and paper. Following a budget can help you identify ways you can add to savings as well as pay down debt. Ways to help you save…

“I’m standing there watching my house burn, and I’m like, oh my goodness, this is everything that I worked for.” When Rahkim Sabree, AFC followed a gut feeling to return home early from an outing in October, he didn’t expect to find his living room engulfed in flames. “It’s when…

Key takeaways Using extra cash to pay off your mortgage loan early can save homeowners a hefty amount of interest over time. However, putting available funds into investments instead might yield a more significant return and make you more money. The answer to which is right for you will depend…

staticnak1983/Getty Images Key takeaways Short-term CDs typically are those that mature within one year, while long-term CDs have terms ranging from three to five years. Currently, some top-earning long-term CDs have slightly higher interest rates than short-term ones. You can use a CD ladder to take advantage of the benefits…

Key takeaways A good credit card APR is a rate that’s at or below the national average, which currently sits just below 20%. While there are credit cards with APRs below 10%, they’re most often found at credit unions or small local banks. If you don’t have good credit, you’re…

Editor's Pick